Value Streams for Optimizing Real Estate Operations. Transforming property pipelines into profit engines

Real estate firms operate in a complex ecosystem of interrelated activities that span property acquisition, development, marketing, leasing, sales, and management. While many organizations focus on optimizing individual departments or functions, this approach often fails to address critical cross-functional inefficiencies that impact customer experience and business outcomes.

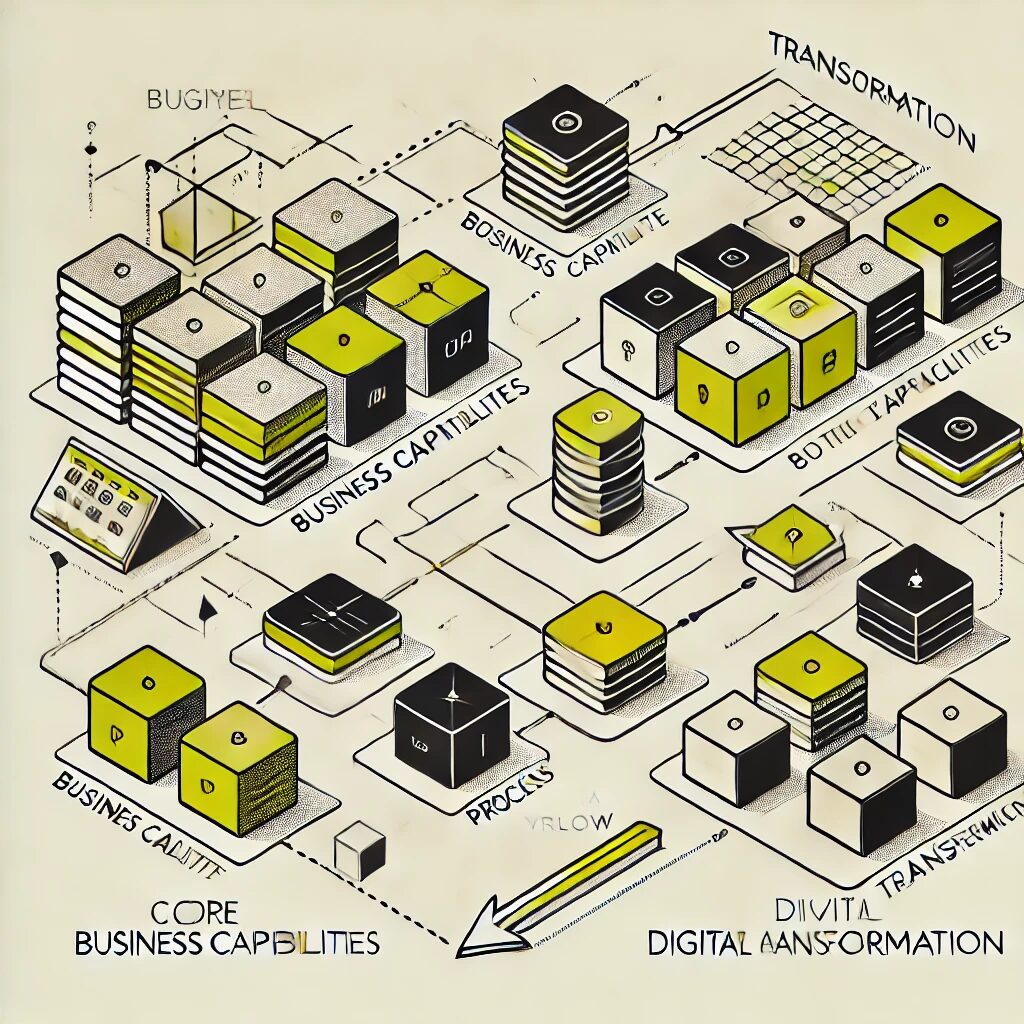

Business Architecture Value Streams provide real estate executives with a powerful framework for visualizing, analyzing, and optimizing end-to-end business processes that deliver value to customers and stakeholders. Unlike traditional organizational views, value streams cut across functional silos to reveal how work actually flows, where bottlenecks occur, and where strategic improvements will yield maximum return on investment.

1: Understanding Business Architecture Value Streams

Value streams represent the end-to-end sequence of activities an organization performs to deliver value to a customer or stakeholder, forming a critical component of business architecture for real estate firms. This architectural view reveals how value flows and where optimization opportunities exist.

- Value Flow Visualization: Value streams capture the sequential flow of value creation from initial trigger to final value delivery, revealing how real estate operations actually work across functional boundaries.

- Customer-Centric Perspective: Unlike process maps that focus on internal workflows, value streams are organized around customer outcomes, ensuring optimizations directly enhance the customer experience.

- Strategic Alignment Tool: Value streams provide a direct connection between strategic objectives and operational execution, ensuring improvement efforts focus on activities with maximum business impact.

- Capability Connection: Value streams link to the business capabilities that enable each stage, creating a comprehensive framework for resource allocation and technology investment.

- Architectural Foundation: As a cornerstone of business architecture, value streams provide context for other architectural views including information, organization, and technology landscapes.

2: Value Streams vs. Traditional Process Approaches

Business Architecture Value Streams differ fundamentally from traditional process improvement approaches, offering real estate firms a more strategic and holistic perspective on operational performance.

- Cross-Functional Visibility: Unlike departmental process maps, value streams span organizational boundaries to reveal interdependencies between functions throughout the real estate lifecycle.

- Outcome Orientation: Where traditional processes focus on activities and tasks, value streams organize around stages that deliver specific business outcomes aligned with strategic objectives.

- Stability Framework: Value streams provide a relatively stable reference model against which multiple operational variations can be analyzed and optimized across different property types or markets.

- Strategic Context: Value streams connect directly to strategic goals and measures, providing business context that traditional process maps often lack in operational improvement efforts.

- Capability Alignment: Value streams explicitly connect to the business capabilities required at each stage, creating clarity on where capability enhancements will improve value delivery.

3: Core Value Streams in Real Estate Operations

Real estate organizations typically operate several core value streams that collectively represent their primary customer-facing operations and value creation mechanisms. Understanding these streams provides a foundation for targeted optimization.

- Property Acquisition: Spanning from market opportunity identification through due diligence to closing, this value stream captures how potential properties are evaluated and added to the portfolio.

- Property Development: Encompassing activities from initial concept through design, construction, and delivery, this value stream reveals opportunities to streamline the development lifecycle.

- Property Marketing and Leasing: Covering prospect identification through lease negotiation to move-in, this value stream highlights critical touchpoints in the tenant or buyer journey.

- Property Management: Including tenant relationship management, maintenance, financial administration and renewal, this value stream reveals how ongoing value is delivered to occupants.

- Property Disposition: From disposition planning through marketing to sale closing, this value stream captures how assets are strategically divested to optimize portfolio performance.

- Investment Management: Spanning investor acquisition, capital deployment, performance reporting and returns distribution, this value stream focuses on value delivered to investment stakeholders.

Did You Know?

- According to a study by the Business Architecture Guild, real estate organizations that implement value stream-based management reduce operational cycle times by an average of 31% and increase first-time-right quality by 28%.

4: Value Stream Mapping Methodology for Real Estate

Developing effective value stream maps for a real estate organization requires a structured methodology that balances architectural rigor with practical applicability. This approach ensures the resulting maps provide accurate insight for operational optimization.

- Scope Definition: Clearly establishing value stream boundaries, customer value proposition, and strategic objectives ensures focused mapping efforts that deliver actionable insights.

- Stakeholder Engagement: Involving representatives from all functions in collaborative workshops ensures comprehensive visibility into how work actually flows across the organization.

- Stage Identification: Defining clear, outcome-focused stages rather than activities creates a strategic perspective that highlights where value is created throughout the real estate lifecycle.

- Performance Metrics: Establishing meaningful measures for time, quality, cost, and customer satisfaction at each stage enables data-driven analysis of value stream performance.

- Capability Alignment: Mapping each stage to the business capabilities that enable it creates a direct connection between value delivery and capability investment decisions.

- Value Stream Visualization: Creating clear, accessible visualizations of value streams makes complex operational relationships understandable to executives and operational leaders.

5: The Property Acquisition Value Stream

The Property Acquisition value stream represents how real estate organizations identify, evaluate, and acquire properties that meet portfolio objectives. Optimizing this stream directly impacts investment quality and portfolio performance.

- Market Analysis: The value stream begins with market research capabilities that identify potential acquisition targets aligned with investment strategy and portfolio objectives.

- Opportunity Evaluation: Financial modeling, risk assessment, and strategic alignment capabilities combine to evaluate potential acquisitions against established investment criteria.

- Due Diligence: Property inspection, financial verification, legal review, and environmental assessment capabilities ensure comprehensive risk evaluation before acquisition commitment.

- Transaction Execution: Negotiation, financing, documentation, and closing capabilities work together to execute acquisitions efficiently while protecting organizational interests.

- Integration Planning: Portfolio integration, operational handoff, and performance baseline capabilities ensure newly acquired properties transition smoothly into ongoing management.

6: The Property Development Value Stream

The Property Development value stream captures how organizations transform raw land or redevelopment opportunities into completed real estate assets. Optimization here directly impacts project profitability and development cycle time.

- Concept Development: Market analysis, financial feasibility, and conceptual design capabilities combine to create development concepts that align with market demands and financial objectives.

- Entitlement Management: Zoning, permitting, community engagement, and regulatory compliance capabilities navigate the complex approval landscape required before construction can begin.

- Design Management: Architectural programming, engineering coordination, sustainability integration, and value engineering capabilities translate concepts into constructible designs.

- Construction Delivery: Procurement, contractor management, quality control, and schedule management capabilities ensure efficient execution of the physical development process.

- Closeout and Transition: Systems commissioning, documentation, warranty management, and operational handover capabilities ensure smooth transition to leasing and property management.

7: The Property Marketing and Leasing Value Stream

The Property Marketing and Leasing value stream represents how organizations attract, convert, and onboard tenants or buyers. Optimizing this stream directly impacts occupancy rates, lease pricing, and customer satisfaction.

- Market Positioning: Target segmentation, competitive analysis, value proposition development, and pricing strategy capabilities establish the foundation for effective property marketing.

- Lead Generation: Digital marketing, broker relationship management, event coordination, and referral program capabilities create a pipeline of qualified prospects.

- Prospect Engagement: Property showcasing, proposal development, negotiation, and objection handling capabilities convert initial interest into signed agreements.

- Transaction Management: Documentation, credit verification, approval processing, and execution capabilities efficiently finalize leasing or sales transactions.

- Tenant Onboarding: Move coordination, orientation, relationship establishment, and service initialization capabilities create a positive transition into occupancy.

8: The Property Management Value Stream

The Property Management value stream captures how organizations deliver ongoing value to tenants while maintaining asset value. Optimization in this stream impacts tenant retention, operating costs, and property performance.

- Tenant Relationship Management: Communication, service coordination, issue resolution, and satisfaction measurement capabilities build strong relationships that enhance retention.

- Facility Operations: Preventive maintenance, service vendor management, systems monitoring, and energy management capabilities ensure efficient, reliable building operations.

- Financial Administration: Rent collection, expense management, budget adherence, and financial reporting capabilities maximize net operating income and financial performance.

- Compliance Management: Regulatory monitoring, safety program management, insurance verification, and inspection coordination capabilities reduce legal and operational risks.

- Renewal Management: Tenant retention planning, lease renewal negotiation, improvement planning, and transition management capabilities maximize occupancy stability and minimize turnover costs.

Did You Know?

- McKinsey research indicates that real estate firms using value stream optimization achieve 15-25% higher operating margins than industry peers still using traditional functional management approaches.

9: Value Stream Performance Analysis

Once mapped, value stream analysis reveals significant improvement opportunities by highlighting bottlenecks, delays, redundancies, and quality issues across the real estate operational landscape.

- Cycle Time Analysis: Measuring the total time and individual stage durations reveals where delays occur in critical value streams such as leasing or development, directly impacting revenue realization.

- Handoff Evaluation: Examining transition points between stages exposes communication gaps, data inconsistencies, and coordination issues that cause delays and errors in property operations.

- Value-Added Assessment: Analyzing which activities truly create customer value versus those that simply add time and cost identifies waste reduction opportunities throughout the real estate lifecycle.

- Quality Analysis: Evaluating error rates, rework, and customer satisfaction at each value stream stage highlights quality improvement opportunities that enhance both efficiency and customer experience.

- Resource Utilization: Examining how people, systems, and information are deployed across value streams reveals resource imbalances and allocation opportunities across property operations.

10: Value Stream Technology Enablement

Value streams provide the ideal framework for aligning technology investments with operational priorities, ensuring systems directly support how value flows to customers and stakeholders.

- Digital Continuity Assessment: Value stream analysis reveals where information flows break across systems, creating opportunities for integration that enhances operational efficiency.

- Automation Opportunity Identification: Examining high-volume, repetitive activities within value streams highlights prime candidates for robotic process automation or intelligent automation.

- Technology Gap Analysis: Mapping systems to value stream stages exposes where missing or inadequate technology constrains operational performance in critical areas.

- Investment Prioritization: Understanding which value stream stages have highest strategic impact guides technology investment toward areas with maximum business return.

- Architecture Alignment: Value streams inform application architecture decisions by clarifying process flows, integration requirements, and data needs across the customer journey.

11: Value Stream-Based Operating Model Design

Value streams provide a powerful foundation for designing organizational structures that align with how work actually flows rather than traditional functional hierarchies.

- Role Alignment: Value stream mapping clarifies roles and responsibilities at each stage, highlighting opportunities to realign positions around value delivery rather than departmental boundaries.

- Team Structure Optimization: Understanding value flow patterns reveals where cross-functional teams might replace siloed departments to improve coordination and reduce handoffs.

- Governance Framework: Value streams inform governance structures that manage end-to-end processes rather than just functional activities, improving accountability for customer outcomes.

- Performance Measurement: Value stream analysis enables metrics that measure cross-functional performance rather than just departmental efficiency, aligning incentives with customer value.

- Skill Development Planning: Identifying capability requirements across value streams highlights skill gaps and development needs that traditional organizational views might miss.

12: Value Stream-Based Process Optimization

While value streams provide the strategic framework, detailed process optimization within each stream drives operational efficiency and effectiveness improvements.

- Critical Path Focus: Value stream analysis identifies which processes within the stream most directly impact overall performance, focusing improvement efforts where they matter most.

- Parallel Processing Opportunities: Examining sequential activities reveals where work can be performed concurrently to reduce total cycle time in development, leasing, or transaction value streams.

- Decision Point Optimization: Analyzing approval and decision points within value streams uncovers opportunities to streamline governance while maintaining appropriate controls.

- Standardization Potential: Comparing process variations across property types or locations identifies best practices that can be standardized to improve consistency and reduce complexity.

- Digital Process Redesign: Understanding end-to-end value flows enables process redesign that fully leverages digital capabilities rather than simply automating existing processes.

13: Customer Experience Enhancement Through Value Streams

Value streams provide a unique customer-centric perspective that enables experience improvements aligned with how customers actually interact with the real estate organization.

- Journey Integration: Mapping customer journeys against value streams reveals disconnects between customer expectations and internal processes that affect satisfaction and loyalty.

- Moment of Truth Identification: Value stream analysis highlights critical interactions that disproportionately impact customer perception, enabling focused experience enhancement efforts.

- Feedback Loop Integration: Examining how customer feedback flows through value streams reveals opportunities to create more responsive, adaptive processes that continuously improve.

- Touchpoint Consistency: Value stream mapping exposes how different organizational functions impact customer experience, enabling more consistent service delivery across all interactions.

- Experience Measurement: Value stream metrics can be enriched with customer satisfaction data to create a more complete picture of both operational efficiency and experience quality.

14: Value Stream Implementation Approach

Implementing value stream-based management in real estate organizations requires a thoughtful approach that balances architectural rigor with practical business application.

- Executive Sponsorship: Securing leadership commitment by connecting value stream optimization to strategic objectives and tangible business outcomes ensures necessary organizational support.

- Pilot Selection: Choosing a high-impact value stream with visible performance challenges demonstrates value quickly and builds momentum for broader implementation.

- Cross-Functional Teams: Establishing teams organized around value streams rather than functions creates ownership for end-to-end performance improvement and customer outcomes.

- Metrics Implementation: Developing and monitoring value stream performance metrics creates visibility and accountability for improvements in cycle time, quality, and customer satisfaction.

- Continuous Improvement Culture: Embedding regular value stream review and optimization in organizational rhythms ensures sustained focus on operational excellence and adaptation.

15: Future-State Value Stream Architecture

Value stream thinking extends beyond current operations to envision how emerging technologies and business models might transform how real estate organizations deliver value in the future.

- Digital Value Stream Transformation: Reimagining value streams leveraging technologies like IoT, AI, blockchain, and extended reality reveals opportunities for disruptive innovation in property operations.

- Ecosystem Integration: Extending value streams beyond organizational boundaries shows how partners, suppliers, and even customers might be integrated into more collaborative value creation models.

- Platform Business Models: Value stream analysis helps identify where platform approaches might replace traditional linear value chains in areas like property management or leasing.

- Sustainability Integration: Reimagining value streams with environmental impact as a key performance dimension reveals opportunities to embed sustainability throughout real estate operations.

- Experience Innovation: Future-state value stream design enables innovative customer experiences that differentiate the organization in increasingly competitive real estate markets.

Did You Know?

- A Forrester study found that cross-functional teams organized around value streams resolve customer issues 62% faster than teams structured along traditional departmental lines.

Takeaway

Business Architecture Value Streams provide real estate organizations with a powerful framework for visualizing, analyzing, and optimizing end-to-end operations from a customer-centric perspective. By cutting across traditional functional silos, value streams reveal how work actually flows, where bottlenecks occur, and where strategic improvements will yield maximum business impact. This architectural approach enables more effective resource allocation, technology investment, and organizational design directly aligned with how value is delivered to customers and stakeholders. For real estate firms navigating market volatility, changing customer expectations, and digital transformation, value stream architecture creates the operational clarity and strategic alignment needed to enhance both competitive advantage and bottom-line performance.

Next Steps

- Identify 1-2 critical value streams in your organization where performance challenges or strategic importance make them prime candidates for initial mapping and analysis.

- Assemble cross-functional teams with representatives from all departments involved in these value streams to ensure comprehensive perspective and buy-in.

- Conduct a collaborative value stream mapping workshop to document current state flows, performance metrics, pain points, and improvement opportunities.

- Develop a prioritized improvement roadmap based on value stream analysis, focusing on high-impact, achievable changes that demonstrate quick wins.

- Establish value stream performance metrics and review cadences to create accountability and ensure sustainable focus on end-to-end optimization.

- Integrate value stream thinking into strategic planning, technology investment, and organizational design decisions to drive continued alignment between operations and strategy.