Value Stream Architecture for Transforming Life Insurance Operations. Unleashing Performance Through End-to-End Value Visibility

In today’s rapidly evolving insurance landscape, life insurers face mounting pressure to enhance operational efficiency while simultaneously improving customer experience. Traditional approaches focusing on isolated process improvements or technology implementations have proven insufficient to drive enterprise-wide transformation. Business architecture value streams offer a powerful alternative by providing an end-to-end perspective that connects customer journeys to the business capabilities that deliver value.

Unlike process-focused methodologies such as Lean, business architecture value streams represent the enterprise’s conceptual flow of value creation. These architectural constructs reveal optimization opportunities hidden in siloed views by mapping how value moves from triggering events to end stakeholders. For life insurers, value stream architecture addresses the unique challenges of long-duration customer relationships, complex product structures, and multi-channel distribution models.

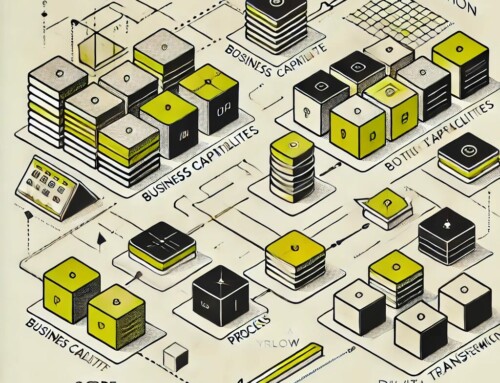

1: Understanding Business Architecture Value Streams

Business architecture value streams provide a strategic lens for visualizing how value flows through an organization to customers and stakeholders. This architectural construct establishes the foundation for operational optimization initiatives.

- Value Stream Definition: A value stream represents an end-to-end series of value stages that create a specific outcome for a particular stakeholder, independent of organizational boundaries or implementation details.

- Strategic Orientation: Unlike process maps that focus on how work is done, value streams focus on what value is delivered, providing a stable reference model that remains relevant even as implementations change.

- Customer Centricity: Value streams begin with a triggering event (often customer-initiated) and conclude with the delivery of value to an end stakeholder, ensuring customer outcomes remain central to optimization efforts.

- Capability Alignment: Each value stage within a stream identifies the business capabilities required to deliver that increment of value, creating the critical link between customer experiences and operational components.

- Implementation Independence: Value streams remain abstract from specific processes, technologies, and organizational structures, allowing them to serve as a stable foundation for transformation initiatives.

2: Life Insurance Value Stream Landscape

Life insurers typically manage multiple value streams that collectively encompass the full spectrum of customer and stakeholder interactions. Understanding this landscape provides the context for targeted optimization efforts.

- Product Development Stream: This value stream transforms market insights into profitable, compliant product offerings that meet customer needs and support distribution strategies.

- Customer Acquisition Stream: This value stream moves potential customers from initial awareness through needs analysis, application, underwriting, and policy issuance.

- Policy Servicing Stream: This value stream supports ongoing customer relationships through various policy changes, inquiries, and transactions throughout the multi-decade policy lifecycle.

- Claims Management Stream: This value stream transforms a beneficiary claim into accurate, timely benefit payments while providing compassionate support during a difficult life event.

- Distribution Management Stream: This value stream enables the recruitment, onboarding, development, and retention of producers across various distribution channels.

- Investment Management Stream: This value stream optimizes the carrier’s investment portfolio to meet policy obligations and financial objectives while managing risk appropriately.

3: Value Stream Construction Methodology

Creating effective value streams requires a structured approach that balances strategic vision with operational reality. The methodology ensures that value streams accurately represent how value flows through the organization.

- Value Identification: The first step defines the specific value delivered to end stakeholders, ensuring clarity about what outcomes the value stream ultimately produces.

- Stakeholder Analysis: Comprehensive stakeholder mapping identifies who initiates, participates in, and ultimately benefits from the value stream.

- Stage Definition: Each value stream breaks down into 5-9 sequential value stages that represent incremental value creation, independent of organizational boundaries.

- Capability Mapping: For each value stage, the methodology identifies which business capabilities are required to deliver that increment of value.

- Cross-Stream Integration: The approach identifies touchpoints and dependencies between value streams to ensure enterprise-wide coherence.

4: The Customer Acquisition Value Stream

The customer acquisition value stream represents one of the most critical value flows for life insurers, directly impacting growth, profitability, and market position. Value stream architecture reveals optimization opportunities across this complex journey.

- Value Stage Articulation: This value stream typically encompasses stages including lead generation, needs analysis, solution development, application, underwriting, and policy issuance.

- Cross-Functional Visibility: Value stream mapping reveals how value creation spans marketing, sales, underwriting, and operations functions, highlighting coordination requirements.

- Digital Integration Points: The value stream perspective identifies where digital capabilities can enhance or replace traditional interactions to improve customer experience.

- Capability Bottlenecks: Mapping capabilities to value stages reveals where capability limitations create delays or friction in the customer acquisition journey.

- Measurement Alignment: Value stream architecture connects stage-specific metrics to end-to-end outcomes, ensuring that optimization efforts contribute to overall acquisition effectiveness.

Did You Know

- Optimization Impact: According to a 2023 insurance industry study, carriers implementing value stream-based optimization achieve an average 27% reduction in policy issuance cycle time and 34% improvement in customer satisfaction scores compared to traditional process improvement approaches.

5: The Claims Management Value Stream

The claims value stream represents the ultimate moment of truth in the insurance relationship. Value stream architecture provides the framework for optimizing this emotionally sensitive and operationally complex experience.

- Value Stage Clarity: This value stream typically includes stages such as notification, validation, assessment, decision, payment, and closure, each representing a distinct value increment.

- Emotional Journey Integration: Value stream mapping incorporates both functional and emotional dimensions of the beneficiary experience, ensuring optimization addresses both aspects.

- Capability Prioritization: Mapping capabilities to value stages reveals which capabilities most significantly impact claims experience and efficiency, guiding investment priorities.

- Handoff Optimization: The value stream view highlights transitions between departments that often create delays, enabling targeted improvements to cross-functional workflows.

- End-to-End Measurement: Value stream architecture connects individual process metrics to holistic measures of claims experience and efficiency, providing a comprehensive optimization framework.

6: Value Stream and Capability Integration

The power of business architecture emerges from the integration of value streams and capabilities. This integration creates a dynamic view of how capabilities combine to deliver stakeholder value across the enterprise.

- Value-Capability Matrix: This architectural tool maps which capabilities support which value stages across all value streams, revealing the strategic importance of individual capabilities.

- Reusable Capabilities: The integrated view highlights capabilities that support multiple value streams, identifying opportunities for enterprise-wide capability enhancements.

- Investment Prioritization: Capability heat mapping across value streams reveals which capabilities most significantly impact multiple value flows, guiding optimization investments.

- Redundancy Identification: The integrated view often reveals redundant implementations of the same capability across different value streams, creating opportunities for consolidation.

- Architecture Visualization: Value-capability mapping provides executives with a powerful visualization of how operational components contribute to customer and stakeholder value.

7: Value Stream-Based Process Optimization

Value streams provide the essential context for effective process optimization, ensuring that process improvements align with end-to-end value delivery rather than sub-optimizing functional silos.

- Process Alignment: Value stream architecture enables explicit mapping of processes to value stages, ensuring that process improvements directly enhance value delivery.

- Cross-Functional Integration: The value stream perspective highlights how processes must integrate across departmental boundaries to deliver seamless stakeholder experiences.

- Streamlining Opportunities: Comparing current process flows to ideal value streams reveals unnecessary complexity, redundancy, and non-value-adding activities.

- Automation Prioritization: Value stream mapping helps identify which process enhancements or automations will most significantly improve end-to-end value delivery.

- Experience-Efficiency Balance: The value stream approach ensures that process optimization balances both customer experience improvement and operational efficiency.

8: Technology Enablement Through Value Streams

Value streams provide the business context essential for aligning technology investments with stakeholder value. This alignment ensures that technology initiatives directly enhance the organization’s ability to deliver core value propositions.

- Application Portfolio Alignment: Mapping applications to value streams reveals how well the current technology portfolio supports key value flows.

- Digital Investment Prioritization: Value stream analysis identifies which technology enhancements will most significantly improve end-to-end value delivery.

- System Integration Requirements: The value stream perspective highlights where systems must integrate to support uninterrupted value flow across the organization.

- Technical Debt Impact: Value stream mapping reveals where legacy systems most significantly constrain value delivery, guiding modernization priorities.

- Architecture Evolution: Value streams provide the business context for evolving technology architecture toward more modular, service-oriented approaches that enhance organizational agility.

9: Organizational Alignment Through Value Streams

Value streams provide a powerful lens for optimizing organizational structure and governance. The value perspective reveals opportunities to enhance alignment between structure and strategy.

- Structural Efficiency: Value stream mapping often reveals organizational fragmentation that creates handoff issues and coordination overhead.

- Accountability Enhancement: Establishing value stream ownership alongside functional management creates clear accountability for end-to-end stakeholder outcomes.

- Role Optimization: Value stream analysis helps identify which roles are most critical to value delivery, enabling focused talent development initiatives.

- Metric Alignment: The value stream perspective connects functional KPIs to end-to-end outcomes, ensuring that performance measurement drives cohesive improvement.

- Governance Enhancement: Value stream-based governance mechanisms ensure that operational decisions consider impact on end-to-end stakeholder value rather than optimizing for local metrics.

10: Value Stream-Based Customer Experience Enhancement

Customer experience has become a primary competitive differentiator in life insurance. Value streams provide the architectural framework for systematically enhancing experience across the customer journey.

- Journey-Stream Alignment: Explicit mapping between customer journeys and value streams ensures that experience enhancements directly improve value delivery.

- Moment-of-Truth Identification: Value stream analysis reveals the specific interactions that most significantly impact customer perception of the carrier.

- Experience Gap Analysis: Comparing the current customer journey to the ideal value stream reveals experience gaps and friction points requiring attention.

- Channel Integration: Value stream mapping highlights where inconsistent experiences across channels create customer confusion or frustration.

- Measurement Framework: The value stream approach establishes clear connections between experience metrics and operational performance indicators.

Did You Know

- Digital Transformation Success: Research by Boston Consulting Group found that insurance digital transformation initiatives guided by value stream architecture are 3.2 times more likely to achieve target outcomes than those driven by technology-centric approaches.

11: Digital Transformation Through Value Streams

Digital transformation requires a clear understanding of how digital capabilities will enhance value delivery. Value streams provide this essential context, ensuring that digital initiatives directly improve stakeholder outcomes.

- Digital Opportunity Identification: Value stream mapping reveals where digital capabilities can most significantly enhance value delivery through speed, convenience, or personalization.

- Transformation Sequencing: The value stream perspective helps sequence digital initiatives to build on each other and deliver value incrementally.

- Ecosystem Integration: Value stream analysis identifies opportunities to integrate with external partners and platforms to enhance value proposition.

- Legacy Transition Strategy: Value stream mapping provides the context for managing the transition from legacy to digital approaches while maintaining service continuity.

- Innovation Focus: The value perspective ensures that digital innovation initiatives address real stakeholder needs rather than pursuing technology for its own sake.

12: Value Stream-Based Performance Measurement

Effective performance measurement requires connecting operational metrics to stakeholder outcomes. Value streams provide the framework for this connection, ensuring that measurement drives meaningful improvement.

- End-to-End Metrics: Value stream architecture enables the development of holistic metrics that measure overall value delivery effectiveness.

- Stage-Specific Indicators: The value stream approach identifies appropriate metrics for each value stage, ensuring comprehensive performance visibility.

- Cross-Functional Alignment: Value stream measurement connects functional KPIs to shared outcomes, facilitating collaboration across departmental boundaries.

- Capability Performance Connection: The integrated value-capability view connects capability metrics to value stream performance, highlighting improvement priorities.

- Customer-Centric Measurement: Value stream metrics incorporate the customer perspective, ensuring that internal measures align with external perceptions.

13: Regulatory Compliance Through Value Architecture

The life insurance industry faces complex and evolving regulatory requirements. Value stream architecture provides the framework for embedding compliance into value delivery rather than treating it as a separate overlay.

- Requirement Integration: Value stream mapping identifies where regulatory requirements impact specific value stages, enabling targeted compliance measures.

- Control Rationalization: The value perspective helps consolidate redundant controls that have accumulated across departmental boundaries.

- Risk-Value Balance: Value stream architecture enables appropriate balancing of risk management and customer experience considerations.

- Change Impact Analysis: The value stream approach provides a structured framework for assessing how regulatory changes affect value delivery.

- Documentation Framework: Value stream architecture creates clear linkages between regulatory requirements, business capabilities, and operational processes.

14: Value Stream Governance Model

Sustaining value stream-based optimization requires appropriate governance mechanisms. The governance model ensures that value streams remain relevant and continue to drive operational improvements.

- Ownership Structure: Effective governance establishes clear accountability for end-to-end value streams alongside traditional functional responsibilities.

- Review Cadence: The governance model includes regular value stream performance reviews that bring cross-functional stakeholders together around shared outcomes.

- Investment Alignment: Value stream governance ensures that project portfolios and resource allocation decisions align with value delivery priorities.

- Continuous Improvement: The governance approach embeds ongoing value stream enhancement into operational rhythms rather than treating it as a one-time exercise.

- Architecture Integration: Value stream governance connects with broader enterprise architecture governance to maintain alignment across architectural domains.

15: Value Stream Transformation Roadmap

Implementing value stream-based optimization requires a structured approach that delivers incremental benefits while building toward comprehensive transformation. The roadmap methodology ensures sustainable progress.

- Current State Assessment: The transformation begins with mapping current value streams and evaluating their effectiveness against stakeholder expectations.

- Future State Vision: The approach develops an ideal future state for priority value streams, incorporating both strategic objectives and operational realities.

- Gap Analysis: Systematic comparison between current and future states reveals specific improvement opportunities across value stages.

- Initiative Development: The methodology translates improvement opportunities into specific initiatives with clear scope, outcomes, and resource requirements.

- Roadmap Sequencing: Initiatives sequence into a multi-year roadmap that balances quick wins with longer-term structural enhancements.

Did You Know

- Organizational Adoption: While 73% of life insurance executives recognize the strategic importance of value stream architecture, only 24% report having fully implemented value stream-based operating models across their organizations.

Takeaway

Business architecture value streams provide life insurers with a powerful framework for operational optimization that transcends traditional functional boundaries. By mapping how value flows from triggering events to end stakeholders, value streams reveal improvement opportunities that remain hidden in process-centric or technology-centric views. The integration of value streams with business capabilities creates a dynamic architectural model that connects customer journeys to the operational components that deliver value. Organizations that embed value stream thinking into their planning, governance, and measurement systems achieve greater alignment between strategic objectives and operational initiatives, more efficient resource allocation, and more sustainable transformation outcomes.

Next Steps

- Identify Your Core Value Streams: Document the 5-7 primary value streams that define how your organization delivers value to customers and key stakeholders.

- Conduct a Value Stream Assessment: Evaluate your most critical value stream to identify bottlenecks, gaps, and opportunities for enhancement.

- Connect Value to Capabilities: Map which business capabilities support each stage of your priority value streams to reveal strategic improvement opportunities.

- Establish Value Stream Governance: Define clear ownership and review mechanisms for your core value streams alongside traditional functional management.

- Develop Experience-Based Metrics: Create measurement systems that connect operational performance to customer experience across the end-to-end value stream.