Optimizing Life Insurance Through Business Architecture. From Siloed Operations to Integrated Excellence: Mapping the Future of Insurance

Today’s life insurance carriers face unprecedented challenges from market disruption, legacy technology constraints, and evolving customer expectations. In this complex landscape, business capability maps have emerged as the essential architectural tool for aligning strategic vision with operational reality. By providing a comprehensive view of what the organization does—distinct from how it does it—capability maps create the foundation for both business optimization and technology rationalization.

For life insurance carriers specifically, capability mapping offers unique advantages in addressing industry-specific challenges. The multi-decade nature of life insurance products, regulatory complexity, and traditionally siloed operations make capability-based approaches particularly valuable for revealing optimization opportunities that remain hidden in process-centric or technology-centric views.

1: The Capability Crisis in Life Insurance

Life insurance carriers operate some of the most complex business and technology environments across industries. This complexity has evolved over decades, often resulting in operational inefficiencies and technology fragmentation that impede transformation efforts.

- Siloed Operations: Life insurance operations have traditionally developed in functional silos, creating redundant capabilities that increase costs and reduce organizational agility.

- Legacy Technology Burden: Many carriers maintain 30+ year-old systems that consume disproportionate resources while constraining business innovation.

- Process Proliferation: Without a capability-based reference model, processes multiply over time, creating unnecessary variation that increases operational complexity.

- Strategic Misalignment: Disconnection between strategic objectives and operational reality frequently leads to investments that fail to address core capability deficiencies.

- Measurement Challenges: Functional metrics often obscure end-to-end capability performance, making it difficult to identify true optimization opportunities.

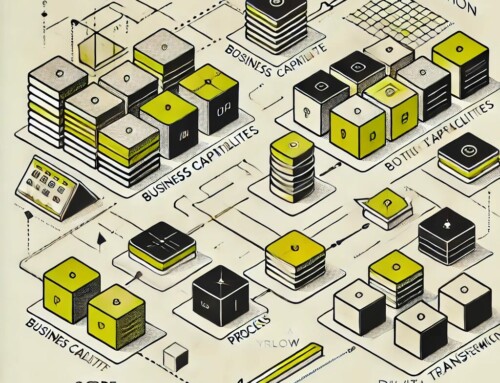

2: Capability Mapping Fundamentals

A business capability map provides a comprehensive, stable inventory of what an organization does, independent of how those functions are performed. This distinction is crucial for optimization efforts.

- Capability Definition: Each capability represents a discrete business function that delivers specific value, described in technology-agnostic, process-agnostic terms.

- Hierarchical Structure: Effective capability maps organize into three levels—domains, capability groups, and discrete capabilities—providing both strategic perspective and operational detail.

- Mutual Exclusivity: Well-constructed maps ensure capabilities do not overlap, establishing clear boundaries that facilitate ownership and accountability.

- Stability Over Time: Unlike processes or technologies, capabilities remain relatively constant, providing a stable reference for multi-year transformation programs.

- Strategic Context: Capabilities connect directly to strategic objectives, making them the ideal unit for prioritizing optimization investments.

3: The Life Insurance Capability Landscape

The life insurance business model encompasses several distinct capability domains that work together to create a comprehensive operational framework. Understanding these domains provides the foundation for optimization efforts.

- Product Development: This domain encompasses the capabilities required to design, price, and bring new insurance products to market while maintaining existing offerings.

- Distribution Management: These capabilities support diverse sales channels including agents, brokers, direct-to-consumer, and emerging digital platforms.

- Underwriting & New Business: This domain covers risk evaluation, application processing, and policy issuance capabilities that directly impact profitability and growth.

- Policy Administration: These capabilities manage the decades-long relationship between carrier and policyholder, supporting every aspect of servicing in-force policies.

- Claims Management: This domain encompasses the capabilities for processing death claims and other benefits with accuracy, efficiency, and empathy.

- Asset Management: These capabilities enable carriers to manage investment portfolios that support both policy guarantees and company profitability.

4: Revealing Operational Inefficiencies

A well-constructed capability map provides powerful insights into operational weaknesses that would remain hidden in process-centric or organizational views. These revelations create the foundation for targeted optimization.

- Capability Fragmentation: Mapping often reveals that critical capabilities like customer information management are fragmented across multiple business units, creating inconsistency and redundancy.

- Redundant Implementation: Many carriers discover that fundamental capabilities like document management are implemented multiple times across different business functions, increasing costs and complexity.

- Maturity Inconsistency: Capability assessment frequently shows that while some capability instances achieve high maturity, the same capability performs poorly in other areas of the organization.

- Functional Silos: Capability mapping highlights how organizational boundaries interrupt end-to-end capabilities, creating handoff issues that impact customer experience and operational efficiency.

- Resource Misallocation: The capability view often reveals that resource allocation does not align with capability importance, with critical capabilities receiving insufficient investment.

5: Streamlining the Technology Landscape

Beyond operational insights, capability maps provide the essential context for technology rationalization. The capability view transforms IT planning from a system-centric to a business-value-centric discipline.

- Application Portfolio Alignment: Mapping applications to the capabilities they support reveals redundancy, gaps, and misalignment in the technology portfolio.

- Technology Rationalization: Capability-based assessment enables informed decisions about which systems to retire, replace, or enhance based on business impact rather than technical factors alone.

- Architecture Simplification: The capability perspective helps simplify technical architecture by consolidating similar functions that have proliferated across multiple systems.

- Investment Prioritization: Aligning technology investments with capability importance ensures that limited resources address the most strategically significant needs.

- Legacy Modernization Strategy: Capability maps provide the business context essential for creating a modernization roadmap that delivers incremental value while managing risk.

Did You Know

- Transformation Success Rates: According to McKinsey research, insurance companies that use capability-based approaches for transformation initiatives achieve a 65% success rate, compared to just 30% for companies using traditional project-based approaches.

6: Enhancing Customer Experience Through Capability Alignment

Customer experience has become a primary competitive differentiator in life insurance. Capability mapping provides the framework for systematically enhancing experience across the customer journey.

- Journey-Capability Alignment: Mapping customer journeys to underlying capabilities reveals which capabilities most directly impact customer experience at each touchpoint.

- Experience Gaps: Capability assessment often uncovers gaps where missing or underdeveloped capabilities create friction in the customer journey.

- Channel Consistency: The capability perspective highlights inconsistencies in how the same capability performs across different customer channels, creating opportunity for standardization.

- Digital Enablement: Capability mapping provides the foundation for digital transformation by identifying which capabilities require digital enhancement to meet customer expectations.

- Measurement Alignment: Connecting experience metrics to capabilities ensures that customer experience improvements target the capabilities with greatest impact.

7: Accelerating Product Innovation

In today’s competitive market, the ability to rapidly develop and launch new products represents a critical advantage. Capability mapping enables targeted improvements that accelerate the product lifecycle.

- Innovation Constraints: Capability assessment reveals which capabilities most significantly constrain the speed and flexibility of product development.

- Reusable Components: The capability perspective facilitates product componentization, enabling new offerings to be assembled from existing capability components.

- Technology Dependencies: Mapping product capabilities to supporting technologies identifies where legacy systems impede innovation and where modern platforms can accelerate it.

- Regulatory Navigation: Capability-based approaches improve regulatory compliance in product development by clearly connecting requirements to specific capabilities.

- Cross-Functional Coordination: Capability mapping highlights interdependencies across functions involved in product development, enabling more effective collaboration.

8: Optimizing Claims Operations

Claims processing represents both a significant operational cost center and a crucial moment of truth in the customer relationship. Capability mapping provides the framework for balancing efficiency, accuracy, and experience in claims operations.

- Process Variability: Capability assessment often reveals unnecessary variation in claims handling that increases costs while creating inconsistent customer experiences.

- Technology Fragmentation: The capability view highlights fragmentation in claims technologies that create inefficiency and impede straight-through processing.

- Automation Opportunities: Mapping claims capabilities against maturity levels identifies specific functions that would benefit most from intelligent automation.

- Risk Control Alignment: Capability mapping ensures that operational efficiency initiatives maintain appropriate risk controls and compliance measures.

- Experience Enhancement: The capability perspective connects operational improvements to customer experience impacts, ensuring optimization efforts address both dimensions.

9: Driving Underwriting Excellence

Underwriting directly impacts both top-line growth and bottom-line profitability. Capability mapping provides the foundation for optimizing this critical function through targeted improvement initiatives.

- Decision Consistency: Capability assessment often reveals inconsistency in underwriting decision-making that impacts both risk management and customer experience.

- Data Utilization: The capability view highlights gaps in how effectively underwriting leverages available data sources, creating opportunities for enhanced risk assessment.

- Process Efficiency: Mapping underwriting capabilities against performance metrics identifies bottlenecks that extend cycle times and increase acquisition costs.

- Technology Support: Capability mapping reveals where legacy systems constrain underwriting innovation and where modern platforms can enhance flexibility and efficiency.

- Channel Alignment: The capability perspective highlights inconsistencies in underwriting approaches across distribution channels, creating opportunities for standardization.

10: Enhancing Distribution Effectiveness

Distribution models in life insurance continue to evolve, with carriers increasingly supporting multiple channels. Capability mapping provides the framework for optimizing distribution effectiveness across this complex ecosystem.

- Channel Capability Alignment: Mapping reveals which capabilities require enhancement to support specific distribution channels effectively.

- Producer Experience: Capability assessment often identifies gaps in producer support capabilities that impact recruitment, retention, and productivity.

- Compensation Management: The capability view frequently highlights inefficiencies in commission systems that increase costs and create producer dissatisfaction.

- Cross-Channel Consistency: Capability mapping reveals inconsistencies in how the same capability performs across different distribution channels, creating opportunity for standardization.

- Digital Enablement: The capability perspective identifies which distribution capabilities require digital enhancement to meet producer and customer expectations.

Did You Know

- Technology Redundancy: A study of mid-sized life insurers found that without capability mapping, the average carrier maintains 3.8 systems performing substantially similar functions, with each system averaging 40-60% utilization.

11: Optimizing Policy Administration

Policy administration represents both a significant operational cost center and a critical source of customer satisfaction or dissatisfaction. Capability mapping provides the framework for targeted improvements in this complex domain.

- Service Consistency: Capability assessment often reveals inconsistency in policy servicing capabilities across products and channels that impacts customer experience.

- Operational Efficiency: The capability view highlights redundancies in policy administration functions that increase costs and processing time.

- Technology Constraints: Mapping policy administration capabilities to supporting systems reveals where legacy technology most significantly impacts operational performance.

- Self-Service Enablement: Capability mapping identifies which policy servicing capabilities would benefit most from customer self-service capabilities.

- Regulatory Compliance: The capability perspective ensures that operational improvements maintain appropriate controls for regulatory compliance.

12: Building the Optimization Roadmap

Translating capability insights into actionable improvement initiatives requires a structured approach that balances strategic importance, current performance, and implementation feasibility.

- Maturity Assessment: Evaluating each capability against defined maturity criteria establishes a baseline that highlights the gap between current and desired performance.

- Strategic Alignment: Mapping capabilities to strategic objectives ensures that improvement initiatives focus on the capabilities most critical to organizational success.

- Capability Prioritization: Combining strategic importance with performance gaps creates a prioritized list of capabilities for optimization focus.

- Initiative Definition: Developing specific improvement initiatives for high-priority capabilities translates assessment insights into actionable projects.

- Roadmap Development: Sequencing initiatives based on dependencies, resource constraints, and value delivery creates a multi-year optimization roadmap.

13: Governance for Sustainable Optimization

Effective governance ensures that capability-driven optimization delivers sustainable value rather than one-time improvements. The governance framework maintains alignment between strategic objectives and operational initiatives.

- Capability Ownership: Assigning clear ownership for each capability establishes accountability for performance monitoring and continuous improvement.

- Performance Metrics: Developing capability-specific metrics enables objective evaluation of whether optimization initiatives deliver expected outcomes.

- Investment Alignment: Requiring business cases to explicitly identify capability impacts ensures that investments directly address priority capability gaps.

- Regular Reassessment: Establishing a cadence for reassessing capability maturity tracks optimization progress and identifies emerging priorities.

- Continuous Improvement: Building capability enhancement into operational rhythms transforms optimization from a project to an ongoing discipline.

14: Technology Portfolio Management Through Capability Lens

Effective technology portfolio management requires a business-centric view that connects systems to the capabilities they enable. This perspective transforms IT governance from a technology-centric to a value-centric discipline.

- Application-Capability Mapping: Documenting which systems support which capabilities provides the foundation for technology rationalization decisions.

- Redundancy Identification: The capability view highlights where multiple systems support the same capability, creating opportunities for consolidation.

- Gap Analysis: Capability mapping reveals where critical capabilities lack adequate technology support, informing investment priorities.

- Lifecycle Management: Connecting systems to capability importance helps prioritize which legacy applications to modernize first.

- Architecture Evolution: The capability perspective guides technology architecture development toward a more modular, service-oriented approach aligned with business capabilities.

15: Measuring Optimization Success

Defining and tracking appropriate metrics ensures that capability-driven optimization delivers measurable business value. The measurement framework should encompass both capability performance and business outcomes.

- Capability Maturity Progression: Tracking capability maturity over time provides direct evidence of whether improvement initiatives achieve their objectives.

- Operational Metrics: Connecting capability improvements to operational metrics like cycle time, error rates, and unit costs quantifies efficiency gains.

- Customer Impact: Measuring how capability enhancements affect customer experience metrics demonstrates the external impact of optimization efforts.

- Financial Outcomes: Tracking how capability improvements impact financial metrics like expense ratios and revenue growth validates business value.

- Strategic Alignment: Regularly reassessing how capability performance contributes to strategic objectives ensures optimization efforts remain focused on organizational priorities.

Did You Know

- ROI Impact: Forrester Research reports that life insurance carriers using capability-based portfolio management methods achieve 40% higher return on IT investments than carriers using traditional technology-centric approaches.

Takeaway

Business capability mapping provides the architectural foundation for systematically optimizing operations and streamlining technology in life insurance organizations. By creating a comprehensive view of what the business does—independent of how those functions are currently performed—capability maps reveal inefficiencies, redundancies, and improvement opportunities that remain hidden in process-centric or technology-centric approaches. Organizations that embed capability-based methods in their planning and governance processes achieve greater alignment between strategic objectives and operational initiatives, more efficient resource allocation, and more sustainable transformation outcomes.

Next Steps

- Develop Your Capability Map: Create a comprehensive inventory of your organization’s business capabilities, leveraging industry reference models to accelerate development and ensure completeness.

- Conduct a Capability Assessment: Evaluate current capability performance against strategic importance to identify priority areas for optimization focus.

- Map Applications to Capabilities: Document which systems support which capabilities to reveal technology redundancies, gaps, and modernization priorities.

- Build Your Optimization Roadmap: Define specific improvement initiatives for high-priority capabilities and sequence them into a multi-year roadmap.

- Establish Capability Governance: Implement ownership, metrics, and review processes that maintain focus on capability performance and continuous improvement.